As we move through 2025, the demand for investment-grade sapphires has outpaced many traditional luxury assets. But unlike diamonds—which are valued for their lack of color—sapphire value is driven by the presence of rich, complex hues.

If you are a high-net-worth individual or a professional looking to move capital into tangible assets, this technical breakdown of the 4Cs will serve as your primary due diligence framework.

1. Color: The Supreme Value Driver (Hue, Tone, and Saturation)

In the sapphire market, Color is King. It accounts for approximately 50-70% of the stone’s total value. For investors, we break color down into three technical dimensions:

- Hue: The primary blue color. Top-tier stones have a “pure” blue hue. Avoid stones with strong secondary tints of green or gray, though a slight violet undertone is often prized in Ceylon Blue Sapphires.

- Tone: How light or dark the stone is. The sweet spot for investment is Medium to Medium-Dark (60-70%). If a stone is too light, it lacks “gravitas”; if it is too dark (often called “inky”), the light cannot dance within the facets, killing the value.

- Saturation: The “vividness” of the blue. This is where the 2024 market analysis shows the highest growth. We look for “Vivid” or “Strong” saturation.

2. Clarity: Why “Eye-Clean” is the Gold Standard

Unlike diamonds, where a 10x loupe defines the grade, sapphire clarity is assessed with the naked eye.

- Type II Classification: Sapphires are “Type II” gems, meaning they naturally grow with inclusions.

- The Investment Threshold: For a stone to be investment-grade, it must be “Eye-Clean” at a distance of about 15 inches.

- The “Silk” Exception: Microscopic rutile needles (silk) can actually increase value if they create a “velvety” appearance (characteristic of Kashmir stones) and prove the sapphire is unheated.

3. Cut: Precision vs. Carat Retention

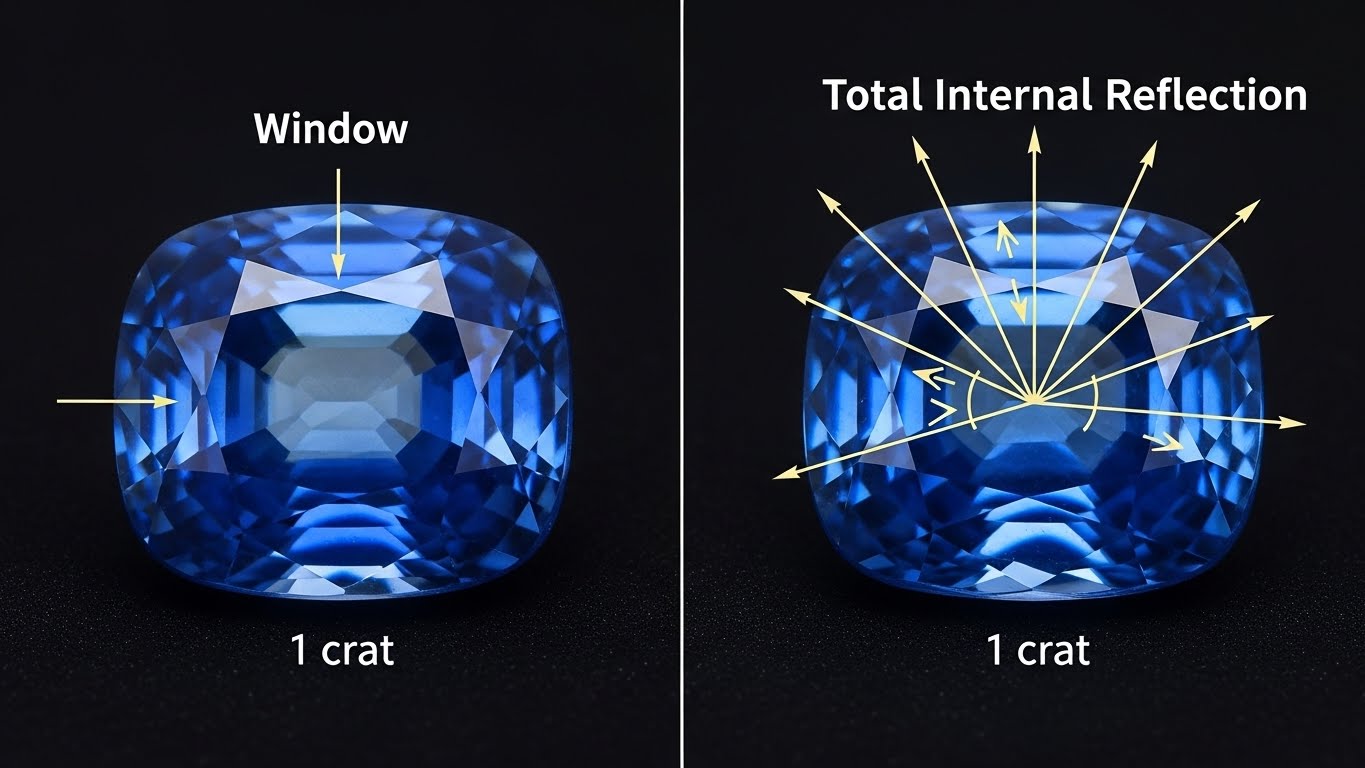

The cut of a sapphire isn’t just about shape; it’s about light return.

- The “Window” Trap: Many sapphires are cut poorly to “save weight” (carat retention). This often results in a “window”—a clear, dead spot in the center of the gem where light leaks through.

- Extinction: Conversely, a cut that is too deep creates dark, “dead” areas.

- Strategic Tip: Look for stones with excellent Symmetry and Proportion. A precision-cut stone can command a 20% premium because it maximizes the saturation you already paid for.

4. Carat Weight: The Exponential Price Curve

Carat weight in the Ceylon Blue Sapphire market does not follow a linear price path. It is a curve that spikes at specific “psychological thresholds.”

- The 3-Carat Jump: A 3-carat unheated sapphire is significantly rarer than a 2.9-carat stone.

- The 5-Carat Milestone: In 2025, unheated, eye-clean Ceylon stones over 5 carats are considered “museum quality” and have seen a 12-16% annual price increase.

- Strategy: It is often better to own one exceptional 5-carat stone than five average 1-carat stones. Liquidity at the high end is surprisingly robust.

The “5th C”: Certification (The Investor’s Guardrail)

Technical data is meaningless without a third-party audit. For any investment-grade sapphire, a report from a top-tier lab like GIA, GRS, or SSEF is non-negotiable. This certificate must explicitly state “No Indications of Heating” and, where possible, confirm the Ceylon (Sri Lanka) origin.

Building a Resilient Portfolio

Investing in blue sapphires requires a shift from the “standardized” mindset of diamond buying to a “connoisseur” mindset of color and rarity. By prioritizing Vivid Saturation, Eye-Clean Clarity, and Unheated Status, you are acquiring an asset that has survived centuries of market cycles.

Ready to see the data in person? [Request a Virtual Viewing] of our GIA-certified investment parcels and speak with a senior gemological strategist about your portfolio goals.