In the 2025 gemstone market, the “Origin Premium” has reached an all-time high. For a senior strategist looking to diversify their portfolio, choosing between these three sources is a balancing act between historical prestige, visual brilliance, and accessible entry points.

While all three produce natural corundum, their geological “fingerprints” offer vastly different value propositions.

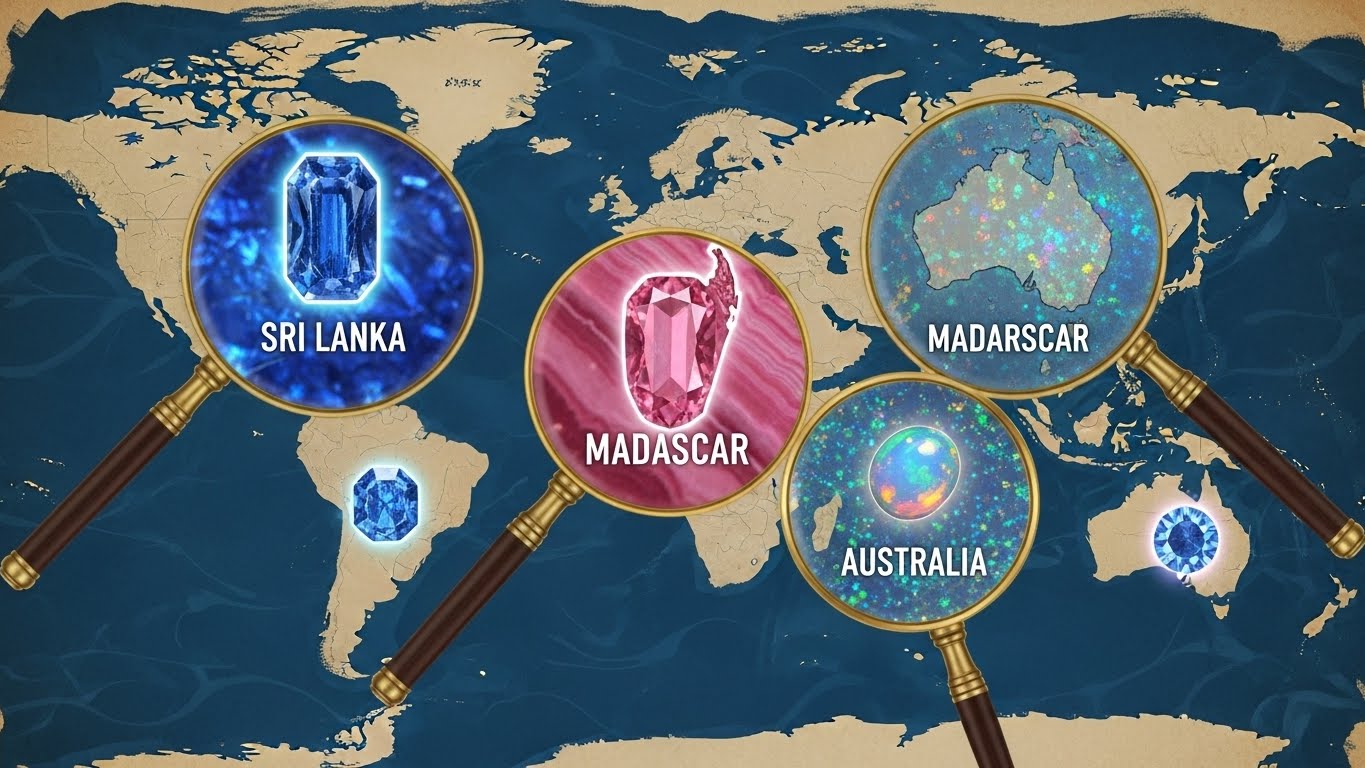

1. Ceylon (Sri Lanka): The Global Gold Standard

Ceylon sapphires (now Sri Lanka) are often cited as the “Benchmark” in modern investment. Known for their “open” color, they do not require heavy treatment to appear vibrant.

- Visual Profile: Characterized by “electric” or “cornflower” blues. Because of low iron content, they rarely appear “inky.”

- The Investment Edge: 2024-2025 market analysis shows a 9% annual growth for unheated Ceylon stones. They possess a “luminosity factor” that causes them to glow even in low-light environments.

- Liquidity: These are the most liquid sapphires in the secondary market. If you need to exit a position, a “Ceylon” origin on a GIA report is universally recognized.

2. Madagascar: The Modern “Powerhouse” Rival

Since the late 1990s, Madagascar has emerged as the most significant challenger to Sri Lankan dominance. In many cases, a top-tier Madagascar sapphire is visually indistinguishable from a Ceylon stone.

- Visual Profile: These stones often share the same velvety, vivid blues found in Sri Lanka. However, Madagascar is also the leading source for “Fancy” colors, including high-grade pinks and yellows.

- The Price Gap: Madagascar sapphires currently offer a 15-20% value discount compared to Ceylon stones of identical quality. For the strategic buyer, this represents a “high-growth” opportunity where the stone’s beauty exceeds its current origin-based price cap.

- Trend Note: As Sri Lankan mines face production hiccups in 2025, Madagascar has stepped in to provide the bulk of the world’s “eye-clean” unheated inventory.

3. Australian: The Durable “Earthy” Alternative

Australian sapphires are geologically distinct, typically found in basaltic deposits rather than the alluvial plains of Sri Lanka.

- Visual Profile: Due to higher iron content, these stones are traditionally darker—ranging from “Midnight Navy” to “Inky Blue.” They often exhibit a characteristic greenish undertone.

- The “Teal & Parti” Niche: While they struggle to compete in the “Royal Blue” category, Australia is the world leader in Teal and Parti (multi-colored) sapphires. These are the fastest-growing niche in the 2025 bridal market.

- Ethical Advantage: Australia offers the world’s most transparent, machine-mined ethical traceability. For the “ESG-conscious” investor, this is a major selling point.

Comparative Market Data (2025 Estimates)

| Origin | 1-2 Carat (Unheated Blue) | Key Visual Trait | 2025 Market Sentiment |

| Ceylon | $4,500−$12,000 | Electric/Cornflower Blue | Prestigous & Stable |

| Madagascar | $3,500−$9,000 | High Brilliance/Velvety | Competitive & Prolific |

| Australia | $800−$3,000 | Dark Blue/Teal/Greenish | Ethical & Niche |

Which Origin Fits Your Portfolio?

If your objective is wealth preservation and high liquidity, the unheated Ceylon Blue Sapphire remains the undisputed king. However, if you are looking for undervalued assets with high aesthetic appeal, Madagascar offers the best “bang for your buck.” Finally, for those targeting the ethical niche or unique “Teal” hues, Australia is the primary source.

Need a side-by-side visual audit? [Schedule a Private Viewing] to see the “Cornflower” of Ceylon vs. the “Brilliance” of Madagascar in person or via 4K digital loupe.